Q3 was the busiest quarter I’ve seen for a long while in the Supply Chain talent market, with extensive executive activity, high optimism and a clear increase in leadership hiring across geographies and industries.

While caution remains in hiring, with extensive interview processes and layers of sign-off for headcounts, companies are returning to market, leading to a cascade of hiring and succession within companies. This is applicable not only for top Supply Chain roles, but at Chief Procurement Officer level, minus one and minus two levels, with particular areas of focus in Plant Leadership, Procurement Transformation and IBP & Digital Transformation within planning.

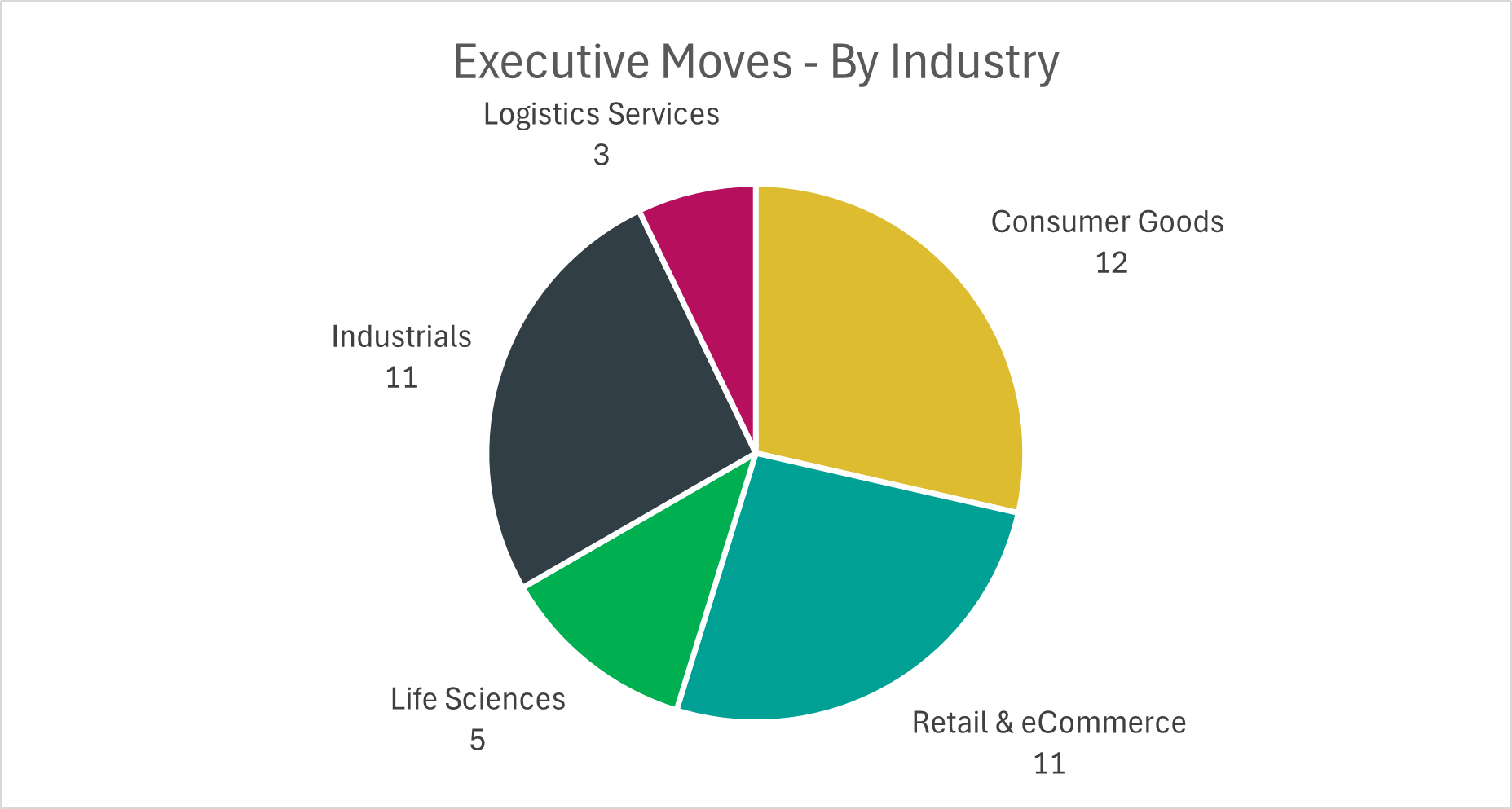

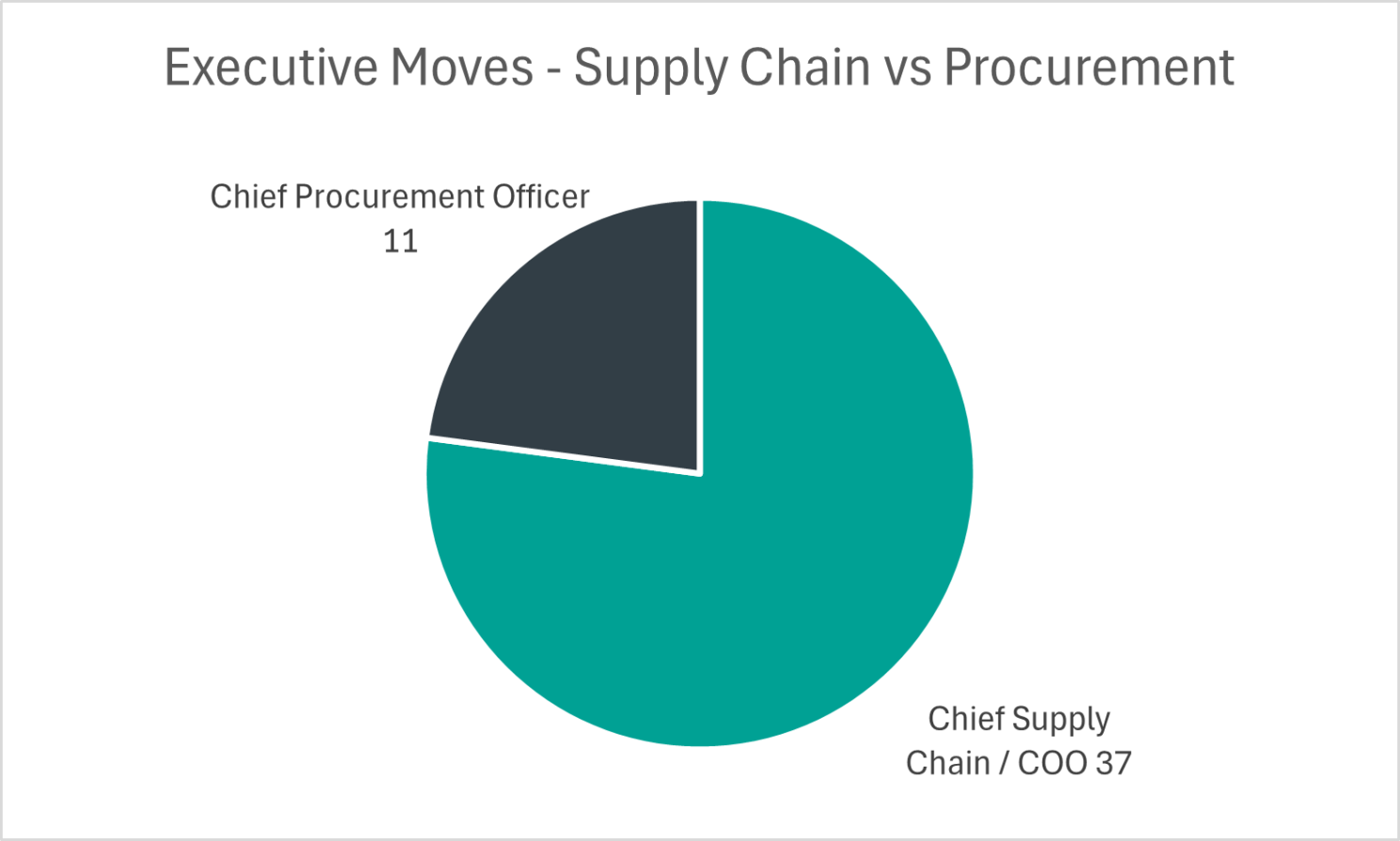

Q3 was once again an incredibly busy quarter for Supply Chain and Procurement moves, with 48 C Suite moves recorded by our team, distributed fairly evenly across FMCG, Retail, Industrials and Life Sciences.

Within this, we saw 11 CPO moves, and 37 CSCO moves; a higher-than-usual number of CPO moves, with similarly high levels of Supply Chain and Operations leadership moves. As a result, we expect high levels of activity in Q4 at both C Suite, as backfills and new openings are required, and -1 levels.

Below are some of the highest profile moves across Q3 in 2025.

Top Chief Supply Chain & Procurement Officer Moves in Q3 2025

North America

- Bacardi: Nicole Zukowski promoted to Chief Supply Chain Officer, while Dave Ingram transitions to Chief People & Business Transformation Officer

- Tyson Foods: Devin Cole steps into the role of Chief Operating Officer, following the departure of the previous CSCO

- Apple: Sabih Khan promoted to Chief Operating Officer

- GXO Logistics, Inc.: Patrick Kelleher appointed CEO, from his previous leadership role at DHL Supply Chain

- Levi Strauss & Co: Chris Callieri joins as Chief Supply Chain Officer, from his role as CSCO of Victoria's Secret

- ALO Yoga: Chris Bonner joins as EVP Operations

- Carrier: Machiel Duijser joins as SVP Operations, following his role as CSCO at Ecolab

- Ecolab: Ben Clark succeeds Machiel as Chief Supply Chain Officer

Europe

- Renault: Francois Provost steps into the role of Chief Executive Officer from his position as Chief Procurement Officer, marking one of the first moves of a CPO to a CEO seen in the market.

- O-I: Donato Giorgio joins as Chief Supply Chain Officer, from his role leading Supply Chain at Essity

- Kraft Heinz: Janelle Aydin steps into the role of Global Chief Procurement and Sustainability Officer

- DHL Global Forwarding: Oscar de Bok appointed CEO, following his leadership of DHL Supply Chain

- DHL Supply Chain: Hendrik Venter steps into the role of CEO, succeeding Oscar de Bok

- PUMA Group: Andreas Hubert appointed Chief Operating Officer, following his extensive career with Adidas

- Sanofi: Vanessa Clemendot joins as Senior Vice President, Global Head of Supply Chain

- Tate & Lyle: Kim Faulkner joins as Chief Supply Chain Officer

Regional Market Insights

While volatility remains, momentum has returned to the market. With positive financial markets and strong opportunities for growth, many companies have pressed forward with their hiring agendas for Supply Chain, and we are now seeing a substantial increase in hiring across the board, with particular shifts in Europe and North America, where the market was previously very quiet.

Supply Chain is a strategic priority for many organisations, as businesses look to secure leadership that can build robust, resilient, and agile global operations. North America picked up significantly in Q3. Global companies are pressing forward with local hiring agendas, both for domestic manufacturing and international strategic leadership, and we are hearing substantial increases in hiring activity from senior leaders across the market. There is a high demand for senior Supply Chain and Procurement leaders from both multinational listed businesses, and continued demand from Private Equity portfolio companies, who have been aggressively headhunting certain markets.

Europe was very quiet as anticipated through the summer, but September saw a significant increase in activity, marked by high levels of movement at C Suite and increased hiring across all levels from Manager to Senior Vice President. We expect Q4 to be incredibly busy for Europe, with the backlog of hiring not only through Q2 but the summer period to happen in rapid succession, leading to substantial hiring activity for both newly created roles and backfills as we move into Q4.

Asia continues to remain incredibly high for hiring demand. As Supply Chain diversification and agility remain high on the agenda for many companies, and we are continuing to see high activity in strategic hires for Supply Chain leadership roles, particularly across markets in Southeast Asia, Taiwan and China. India remains a hotspot for manufacturing and planning leadership, with a notable trend of repatriation for senior domestic roles continuing.

The GCC continues to strengthen as a strategic logistics and manufacturing hub, with high levels of hiring activity and significant demand for Supply Chain and Procurement talent. Dubai remains the preferred location for regional AMEA / MEA leadership, while Riyadh and Jeddah continues to attract investment into manufacturing and logistics functions, driven by Vision 2030 initiatives.

Supply Chain Hiring Trends

As activity increases, there becomes significant pressures on mission-critical roles, from C Suite down to Operational Leadership. A key priority for many organisations is robust pipelining and succession planning; as the market gets busier, the risk of losing critical leaders becomes higher, and many HR teams are working towards building a strong bench across key roles.

We are seeing significant demand in pipelining strong Plant Director and Plant Director -1 talent, particularly in certain hard-to-find markets. The demand for this talent is skyrocketing, with heavy competition for strong manufacturing leaders with language skills and local knowledge. This demand is particularly strong in Europe and Asia.

There is also a renewed focus into Procurement, with a flurry of Chief Procurement Officer hires in Q3, and a continued focus on Procurement transformation, digitisation and excellence. Companies are heavily investing in robust Procurement teams, leading to a high level of competition for top talent.

We are continuing to see investment into Operational Excellence leaders, particularly in certain emerging market locations (In Europe, Iberia and Eastern Europe, in Asia, Malaysia and the Philippines, and LATAM have become strategic locations for these hubs). We are also seeing a renewed focus on Technology, Automation and Supply Chain Data talent, with more companies beginning to explore AI strategies, future Supply Chain optimisations, and investment into emerging technologies.

As we look ahead to Q4, the hiring landscape appears positive – with a significant increase in hiring measured in late Q3, and a cautious optimism in the market, we expect to see a busy Q4 and strong hiring agendas in Supply Chain and Procurement for 2026.

The demand for leaders who can balance transformation with continuity, and ensure a resilient growth strategy continues to grow, and the cascading effect of new C Suite leaders, and increased market moves will trickle down to lead to a much higher volume of activity in the market in the coming months.

If you have any particular insights you’d like to explore, questions on the market, or areas of priority within your own hiring, please feel free to reach out for a conversation.